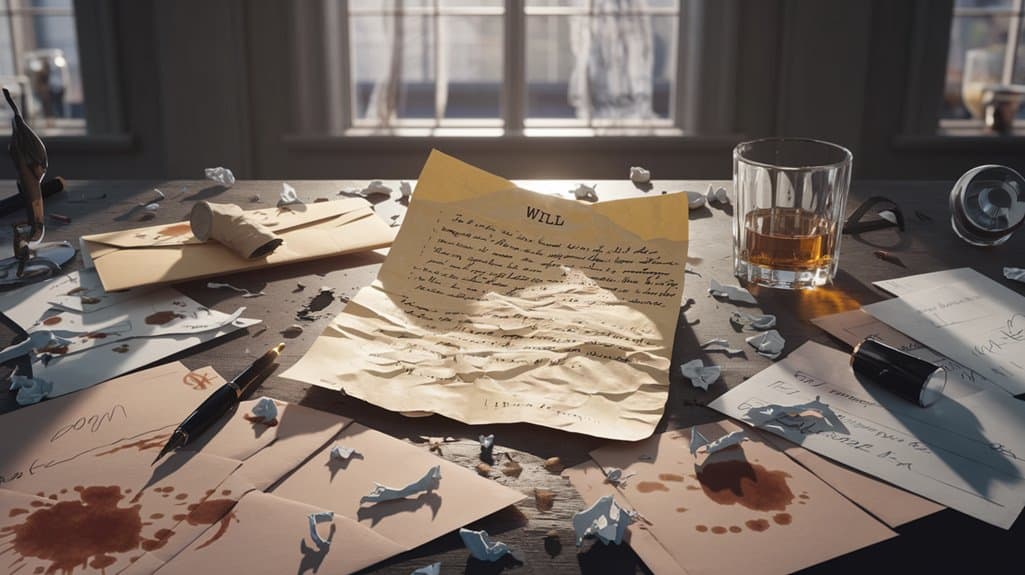

While DIY Wills might seem like a money-saving option, they often lead to costly legal battles and family disputes. You will need to navigate complex requirements like proper witnessing, precise legal language, and strict formatting rules. Even small oversights can invalidate your entire Will, leaving your estate subject to provincial laws. Professional safeguards from estate lawyers protect against challenges and guarantee proper execution. Understanding the full scope of will creation can prevent devastating consequences for your loved ones.

Key Takeaways

- DIY Wills often lack proper witness signatures and formalities, potentially making them invalid and forcing courts to apply intestacy laws.

- Attempting to save money with homemade Wills can result in thousands of dollars in legal fees and court costs after your death.

- Small mistakes like crossing out text or using correction fluid can invalidate entire sections of your Will, or the entire Will, without proper legal attestation.

- Template Wills fail to address complex situations like blended families, business assets, or critical tax-planning opportunities.

- Homemade Wills lack professional safeguards such as capacity assessment, secure storage, and protection against future legal challenges.

Legal Requirements Often Overlooked in DIY Wills

Three critical legal requirements are commonly missed when people create DIY Wills, potentially invalidating their entire estate plan.

First, you will need two witnesses who are not beneficiaries or the executors to sign your Will, and they must sign in your presence.

Second, any alterations or corrections made to your Will after signing your Will may invalidate your Will or require direction of the Court and will increase legal costs to administer your estate.

Third, not including all appropriate clauses can limit the scope of the duties your executor can perform which may have drastic consequences to the estate.

Holographic or handwritten Wills are not valid in BC and should you create a holographic Will, to prove this Will as a valid, your executor must apply to the BC Supreme Court for a court order to validate the document as a Will.

Without proper attention to these requirements, you are risking your Will being declared void, leaving your estate distribution to provincial laws rather than your wishes.

The True Cost of Cutting Legal Corners

While saving money on legal fees might seem attractive initially, attempting to create a Will without professional guidance can lead to substantial financial consequences after your death.

You will likely face increased probate costs, legal fees to correct errors, and potential court challenges that can drain your estate’s resources.

The math is straightforward: while you might save a few hundred dollars upfront, your DIY Will could cost your beneficiaries thousands in legal fees to resolve ambiguities or mistakes.

Common issues include improper witnessing, unclear asset distribution, and overlooked tax implications.

These errors often result in lengthy court proceedings, with legal fees quickly surpassing what you would have spent on professional estate planning services.

Your attempt to save money could ultimately leave your loved ones with a costly legal burden to untangle.

Common Mistakes That Invalidate Homemade Wills

Several common mistakes can quickly render your homemade Will invalid, potentially leaving your estate vulnerable to legal challenges and your final wishes unfulfilled.

You might forget to have two witnesses present when signing, or accidentally choose beneficiaries as witnesses, which can void their inheritance. If you are using correction fluid or crossing out text, these alterations may not be legally recognized without proper attestation.

You will also need to explicitly revoke previous Wills to avoid confusion, and guarantee you have signed and dated the document properly.

Even small oversights, like unclear asset distribution or imprecise language, can lead to your Will being contested in court.

Why Template Wills Fall Short

Although template Wills promise a quick and affordable solution for estate planning, they often create more problems than they solve.

These generic documents cannot account for your unique family dynamics, complex assets, or specific wishes. You are likely to overlook essential legal requirements and tax implications that could invalidate your Will or burden your beneficiaries with unnecessary expenses.

- Template Wills do not adapt to your jurisdiction’s specific laws, potentially making portions of your Will unenforceable.

- Pre-written forms cannot address complex situations like blended families, business ownership, or international assets.

- Generic templates lack the flexibility to incorporate tax-saving strategies or trust arrangements that could benefit your heirs.

When you rely on a template Will, you are gambling with your legacy and risking your family’s financial security.

The money saved upfront could cost your loved ones considerably more in legal fees and taxes later.

Estate Tax Complications From Self-Made Documents

Steering through estate tax implications becomes particularly treacherous when you have created your own Will without professional guidance.

You are likely to overlook essential tax exemptions, deductions, and strategic planning opportunities that could save your beneficiaries thousands in unnecessary taxes.

Without expert knowledge, you might inadvertently trigger capital gains taxes on property transfers or miss opportunities for tax-efficient charitable giving.

You are also at risk of misunderstanding how different assets are taxed upon transfer, from RRSPs to investment portfolios.

Common DIY mistakes include failing to account for probate fees or missing opportunities to establish trusts that could reduce the overall tax burden.

Professional estate planners can structure your Will to maximize tax benefits while ensuring your wishes are properly executed, potentially saving your estate significant amounts in avoidable taxation.

When Family Disputes Arise From Unclear Language

Because homemade Wills often contain vague or imprecise language, they are frequently the catalyst for heated family disputes that can tear relationships apart.

When you draft a Will without professional guidance, you risk creating ambiguous instructions that leave your true intentions open to interpretation. This uncertainty can lead to costly legal battles and irreparable damage to family bonds.

- Unclear distribution terms like “my valuable possessions” or “to be divided equally” can spark intense debates about what items qualify and how to determine fair division.

- Imprecise beneficiary descriptions such as “my children” might exclude adopted children or stepchildren unintentionally.

- Contradictory statements between different sections of the Will can create confusion about your actual wishes, forcing courts to intervene.

Professional Safeguards You Might Be Missing

Legal professionals offer multiple layers of protection that you will not find with a DIY Will. When you work with an estate lawyer, they will verify your identity, assess your mental capacity, and guarantee you are making decisions free from undue influence.

They will also maintain detailed records of your meetings and decisions, which can prove invaluable if your Will faces challenges later.

You are missing out on professional witnessing procedures, secure document storage, and regular updates to reflect changing laws.

Lawyers also provide essential protection against technical errors that could invalidate your Will, such as improper signing or witnessing.

They will make certain your document uses precise legal language that clearly expresses your intentions and complies with current legislation, preventing costly disputes and delays in estate administration.

The Complex World of Asset Distribution

While DIY Wills might seem straightforward when listing who gets what, the reality of asset distribution is far more intricate than most people realize.

You will need to take into account joint accounts, beneficiary designations, and tax implications that could greatly influence how your assets are actually distributed. Without professional guidance, you might create unintended consequences that could leave your loved ones with legal complications.

- Assets are not always solely owned – joint ownership, mortgages, and liens can affect distribution.

- Different types of property have unique transfer requirements – real estate, investments, and personal items, each following distinct rules.

- Tax consequences vary by asset type – retirement accounts, life insurance, and property transfers may trigger different tax obligations.

Beyond simple distribution, you will need to account for debts, administrative costs, and potential challenges that could deplete your estate’s value.

Conclusion

You have seen how a DIY Will can put your estate and loved ones at risk. While saving money upfront might seem appealing, the potential costs of legal battles, tax complications, and family disputes far outweigh the initial investment in professional help. Do not leave your legacy to chance. Protect your assets and your family’s future by working with a qualified estate planning lawyer who will guarantee your final wishes are properly documented and legally sound.

We serve the entire province of BC. Our experienced paralegals can meet with you in Vancouver and throughout the Lower Mainland, making it easier for you to get the assistance that you need. We also have an interior office in Kamloops. That said, our lawyers have the infrastructure to work with any of our clients virtually — even in the furthest regions of British Columbia.

Call (604) 256-7152 [toll free 1 (877) 415-1484] to get routed to the best representative to serve you or contact us online to schedule an appointment.

We also have a dedicated intake form to help you get the ball rolling. Our intake team will review your specific case and advise you on the next steps to take and what to expect moving forward.

Our offices are generally open 8:30 a.m.—5:00 p.m., Mon—Fri.

Vest Estate Law is dedicated to providing you with practical and innovative advice in estate administration, estate planning, and estate disputes, do not hesitate to reach out and one of our knowledgeable staff will respond promptly to arrange a consultation that meets your needs.

Kelly Sullivan

WILLS and ESTATES PARALEGAL

Kelly is a highly accomplished Paralegal with an impressive 28-year tenure in the legal industry, specializing in estate administration and estate planning at Vest Estate Law.